Carl C. Icahn Issues Open Letter to

Stockholders of Southwest Gas

Sunny Isles Beach, Florida, March 14, 2022 — Today, Carl C. Icahn released the following open letter to the stockholders of Southwest Gas Holdings, Inc. (NYSE: SWX).

* * * * *

Icahn Enterprises Increases Price for Southwest Gas Tender Offer to $82.50 per Share

______________________________________

.

.

.

Investor Contacts:

Harkins Kovler, LLC

Peter Harkins / Jordan Kovler

(212) 468-5390 / (212) 468-5384

[email protected] / [email protected]

.

.

.

CARL C. ICAHN

16690 Collins Avenue, Suite PH-1

Sunny Isles Beach, FL 33160

March 14, 2022

Dear Fellow SWX Stockholders:

We are hereby increasing the offering price in our tender offer for ANY AND ALL common shares of SWX to $82.50 per share in cash. We believe our offering price compares quite favorably to the $64.92 per share closing price of SWX common shares on October 13, 2021, the day prior to the initial announcement of our tender offer.

SWX stockholders have an extremely important choice to make in the near-term. There are three options they can choose. If they choose either of the first two options, the results could be extremely profitable. Choosing the third option, however, would likely yield terrible results for stockholders.

The first option is to vote FOR our slate of highly qualified and independent director nominees and participate in our $82.50 per share tender offer. The second option is to just vote FOR our director nominees. The third option is to allow the incumbent SWX board to stay in power and continue the highly unprofitable and value-destructive record of overspending and empire building.

It is unconscionable for SWX management to refuse to disclose the value that the company’s bankers placed on the company when the incumbent board decided that our initial $75 per share bid was “inadequate.” We believe the reason that SWX is hiding this valuation is that it is far above $75 per share. There are several reasons that SWX is hiding this valuation. As we have said before, SWX is very undervalued in the marketplace, mainly because it has been so badly managed. The wider the gap between the market value of SWX and what this valuation opinion says, the worse the board and management look. Because of Hester’s dismal 7-year track record, and his penchant to empire build at the expense of stockholders, he and the board are now trying desperately to entrench themselves. Hester is therefore seeking to issue ~$1 billion of equity to friendly parties even though he undoubtedly knows that this issuance of stock will be at a great discount to the true value of the company. Despite announcing a “separation” of Centuri, SWX is still planning to proceed with this highly dilutive equity financing. Indeed, the only reason we can comprehend for the incumbent SWX board to have approved the highly questionable Questar acquisition in the first place is that this transaction would have forced the company to sell stock to friendly parties. The owners of this bargain stock would undoubtedly support Hester and his cronies no matter how badly they are doing. Such purchasers are called “white squires.” It is obvious that the board and Hester have vastly different agendas and goals than the stockholders. It should be noted that the board and management collectively own well under 1.0% of the company’s stock.

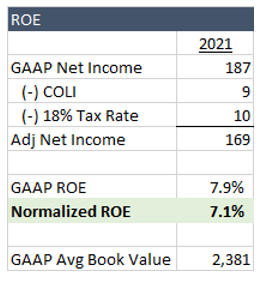

The reason we are increasing our offer price to $82.50 per share in cash and are running a full-slate proxy contest to replace the entire board is that we clearly see significant value that can be achieved if only the albatross of the incumbent board and Hester can be lifted from the neck of this potentially great company. We believe there may be significant strategic and financial interest in both SWX’s services business and Questar and believe that those businesses could be monetized, resulting in material cash flow to SWX, which would eliminate the company’s much publicized equity needs of ~$1 billion. We also think that SWX’s utility itself is materially undervalued due to many years of mismanagement, but all this can be easily corrected with proper oversight from a new board of directors. It is a sad commentary that the utility earns only a 7% return on equity (see Exhibit 1) while its peers earn close to their allowed return at ~9.5%.

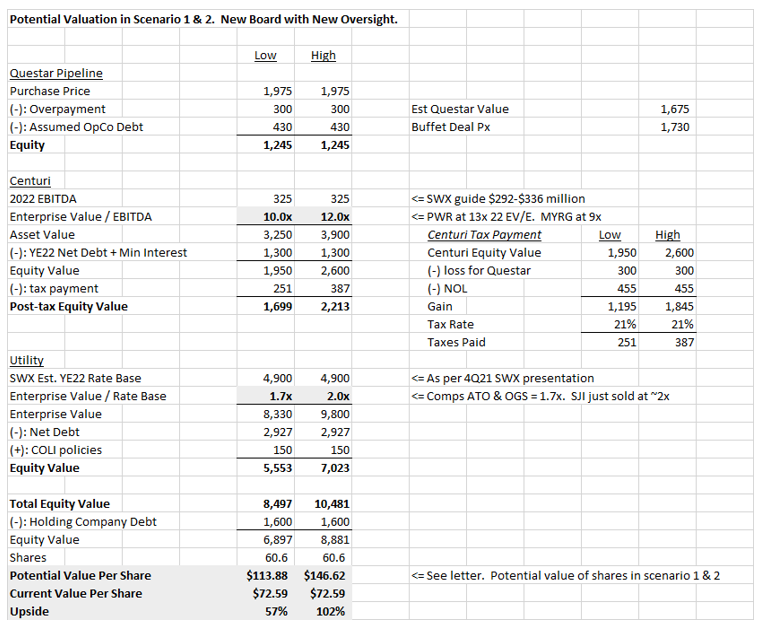

We believe that after our slate of board nominees is elected at the upcoming annual meeting of stockholders, a newly rejuvenated and focused SWX will be able to execute these non-core monetization transactions and immediately start to rebuild trust with regulators. We believe that, under this scenario, SWX could be worth in a range of $110-$150 per share (see Exhibit 2 for details). It is well known that we have turned around many companies over the years. We unlock hidden jewels and avoid issuing equity when prices are low. We put the right people in place to clean up bad oversight, bad management and bad strategies. However, if our slate is not elected, we fear that SWX stock will fall rapidly back to the low $60s, where it was trading before we came on the scene. Hester will still be in charge. Empire building will likely continue. Endless equity will likely continue to be issued at prices which do not take into account the dilutive effect on existing stockholders. But be assured that no matter what happens, one thing is certain: Hester and the board’s income will continue to increase. Keeping the status quo and choosing option three is a very poor and risky choice for stockholders.

Other Reasons Not To Elect Option Three

SWX may be one of the worst run companies in America. Let us recap what has happened in just the past six months:

- SWX overpaid massively for Questar, a no-synergy, no-growth, diversifying asset when the industry is selling non-core assets;

- Created an overhang on the stock by saying the company will in the future issue ~25% of its market capitalization in equity and equity-linked securities to unknown parties, at prices well below fair value;

- Purposely avoided a stockholder vote that we believe should happen whenever a company issues that much equity;

- Enacted an egregious poison pill to block the ability of stockholders to choose for themselves whether they wish to accept our offer;

- Provided exactly zero counteroffers to the multiple public, unconditional proposals we made over the last five months to provide all of the ~$1 billion in equity financing needed to complete the ill-advised Questar acquisition at $75 per share;

- Only announcing a vague plan to “separate” Centuri in a desperate attempt to defeat our tender offer;

- Despite the ability to raise significant cash through that “separation,” management is still planning to dilute existing stockholders by issuing ~$1 billion of equity;

- Newly acquired Questar EBITDA has declined by 7% between October 2021 and March 2022;

- CEO John Hester stated, “definitely we will continue to look at [acquisitions]” but that SWX is “not ready to pull the plug on being a publicly traded company yet,” which means to us that he is closing the door and will not consider any friendly offer for SWX, no matter how high. Once he gets rid of the “Icahn nuisance,” it will be back to business as usual (simply walking on the treadmill and going nowhere); and

- What other value-destructive actions they are scheming, we can only guess.

SWX continues to characterize our tender offer as “highly conditional,” but this is false and misleading. The only meaningful condition to our offer is in the hands of you, the stockholders. If we win the proxy contest, we are confident that the poison pill will be eliminated and those stockholders choosing to tender will receive their money promptly.

Sincerely yours,

.

Carl C. Icahn

______________________________________

.

.

.

Exhibit 1

Exhibit 2

Additional Information and Where to Find It;

Participants in the Solicitation and Notice to Investors

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. (“SOUTHWEST GAS”) FOR USE AT THE ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF SOUTHWEST GAS AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S (“SEC”) WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE PRELIMINARY PROXY STATEMENT FILED BY ICAHN PARTNERS LP AND ITS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON FEBRUARY 15, 2022. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN SOUTHWEST GAS. THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS.

THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES. IEP UTILITY HOLDINGS LLC, AN AFFILIATE OF ICAHN ENTERPRISES, FILED A TENDER OFFER STATEMENT AND RELATED EXHIBITS WITH THE SEC ON OCTOBER 27, 2021. SOUTHWEST GAS FILED A SOLICITATION/ RECOMMENDATION STATEMENT WITH RESPECT TO THE TENDER OFFER WITH THE SEC ON NOVEMBER 9, 2021. STOCKHOLDERS OF SOUTHWEST GAS ARE STRONGLY ADVISED TO READ THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS THEY MAY BE AMENDED FROM TIME TO TIME, BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE TENDER OFFER STATEMENT AND OTHER DOCUMENTS THAT ARE FILED BY IEP UTLITY HOLDINGS LLC WITH THE SEC WILL BE MADE AVAILABLE TO ALL STOCKHOLDERS OF SOUTHWEST GAS FREE OF CHARGE UPON REQUEST TO THE INFORMATION AGENT FOR THE TENDER OFFER. THE INFORMATION AGENT FOR THE TENDER OFFER IS HARKINS KOVLER, LLC, 3 COLUMBUS CIRCLE, 15TH FLOOR, NEW YORK, NY 10019, TOLL-FREE TELEPHONE: +1 (800) 326-5997, EMAIL: [email protected].

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS LETTER:

THIS LETTER CONTAINS OUR CURRENT VIEWS ON THE VALUE OF SOUTHWEST GAS SECURITIES AND CERTAIN ACTIONS THAT SOUTHWEST GAS’ BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. SOUTHWEST GAS’ PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS.

WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS LETTER. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING SOUTHWEST GAS WITHOUT UPDATING THIS LETTER OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this letter are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results to differ materially from the expectations set forth in this letter include, among other things, the factors identified in Southwest Gas’ public filings. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.