Contact:

Icahn Capital LP

Susan Gordon

(212) 702-4309

CARL ICAHN RELEASES OPEN LETTER TO

SANDRIDGE ENERGY STOCKHOLDERS

“VOTE THE GOLD CARD FOR CHANGE!!”

New York, New York, June 4, 2018 – Today Carl Icahn released the following open letter to stockholders of SandRidge Energy, Inc. (NYSE: SD):

Fellow Stockholders:

We are the largest stockholder of SandRidge Energy, Inc., with a position of 4.8 million shares constituting 13.6% of the company’s outstanding stock. We recently filed our definitive proxy statement with the Securities and Exchange Commission regarding our campaign to replace the entire board of directors of SandRidge at the upcoming 2018 annual meeting of stockholders. We believe this drastic measure is warranted because, since emerging from bankruptcy, the board has exhibited a clear and consistent pattern of failure. Time and again the board has failed to understand and address the concerns of stockholders and has only acted when threatened with legal process or open stockholder revolt. And yet, remarkably, they still seem not to have gotten the message.

The company’s proxy statement states: “Since [emerging from bankruptcy], the Board has overseen significant accomplishments, and we are proud of the results that our Company delivered during a challenging period.” Proud of the results??!! The board seems to be describing an entirely different company than the one I and other long-suffering stockholders are familiar with, because the only “accomplishments” I am aware of are the following (and pride is not the emotion that comes to mind when reflecting on them) –

- The board approved a universally ridiculed deal with Bonanza Creek Energy. On November 15, 2017, SandRidge announced that it had entered into an agreement to acquire Bonanza Creek Energy in a massively dilutive and overpriced transaction. Until the surprise announcement of this proposed acquisition, management’s guidance to stockholders had been to protect the balance sheet, reduce operating costs, generate free cash flow and develop its significant remaining inventory in the Northwest STACK and North Park Niobrara in a disciplined manner. The proposed acquisition would have put SandRidge in a fifth and sixth basin with no obvious synergies between any of its assets and was described by one commentator as “an egregious example of how oil companies chase size at the expense of shareholder value.”[i] The announcement resulted in nearly instantaneous condemnation from the largest stockholders of the company, one of whom stated publicly: “The proposed acquisition represents a complete reversal of management’s post-bankruptcy strategy and reminds us of SandRidge’s prior history when this same management team acquired disparate assets and added leverage with reckless abandon.”[ii] Following the announcement of the deal, SandRidge’s stock immediately plummeted 16%, incinerating over $100 million of market value in a single day.[iii] Because the deal was met with such vociferous and overwhelming opposition from a number of large stockholders, including us, it was terminated on December 28th – before even being put to a stockholder vote. Astonishingly, the board continues to this day to defend the failed Bonanza deal with remarkably tone-deaf statements such as “Given BCEI’s actual share price performance relative to SD, BCEI acquisition should have increased SD’s current share price.”[iv] We are extremely concerned that if the current “process” is conducted without parental supervision the board could be entering into similar value-destroying transactions with high break-up fees. Unfortunately, the board’s ill-advised little frolic with Bonanza cost stockholders over $8.2 million in wasted transaction costs. we do not believe the incumbent directors may simply hide behind “business judgment” to explain away this corporate waste but rather should be required to demonstrate how their actions do not constitute gross negligence or a breach of the duties they owe to sandridge and its stockholders.

- The board adopted a poison pill that was an insult to all stockholders. To add insult to injury, the board tried to use an unorthodox poison pill to ram through the wildly unpopular Bonanza deal. The pill broke new ground for poor corporate governance, containing purposely ambiguous provisions that would make a totalitarian dictator blush. For example, it prohibited stockholders from merely talking or meeting with one another to discuss opposition to the Bonanza transaction (but conveniently contained a provision that explicitly gave management the right to campaign in favor of the deal). It appears that the board has never heard of the First Amendment. Does anyone believe that if the incumbent directors are re-elected they will not blatantly disregard stockholders’ rights again?

Because of our repeated demands that SandRidge clarify the language to permit stockholders to fully exercise their right of free assembly without fear of triggering the massively dilutive consequences of the pill, ultimately culminating in a threatened lawsuit, the board was forced to back down and amend the pill to delete the offensive provision. The company’s filings with the Securities and Exchange Commission do not disclose the cost to stockholders of this ill-advised gamesmanship by the board but we are confident, based on the board’s history of wasteful spending, that it was not insignificant. we do not believe the incumbent directors may simply hide behind “business judgment” to explain away this corporate waste but rather should be required to demonstrate how their actions do not constitute gross negligence or a breach of the duties they owe to sandridge and its stockholders.

- The board let former CEO James Bennett slink away with a king’s ransom in severance. SandRidge has a long history of excessive compensation – including a $90 million severance payment to former CEO Tom Ward in 2013 when James Bennett took over as CEO – and that ignoble trend continued unabated after the emergence from bankruptcy. As a reward for participating in over $5 billion in value destruction, overseeing the company’s demise into bankruptcy and completely wiping out the former stockholders, Mr. Bennett received a 2017 base salary that exceeded the 90th percentile of SandRidge’s peer group companies and was awarded over $50 million in compensation during his tenure with SandRidge (not including his recent severance windfall). On February 8th, in direct response to repeated complaints by large stockholders, including us, SandRidge finally announced the firing of Mr. Bennett (as well as CFO Julian Bott). However, by concluding that Mr. Bennett’s termination was without cause, a decision which is shocking considering Mr. Bennett’s stewardship of the company into both a bankruptcy and the Bonanza Creek debacle, Mr. Bennett became entitled to severance under his employment agreement. But that travesty pales in comparison to the unfathomable result that the company’s emergence from bankruptcy constituted a “change in control” under the terms of Bennett’s employment agreement. This means that his firing entitled him to change in control severance benefits of over $17.1 million because of a bankruptcy that occurred under his leadership (while Bott walked away with over $6.5 million). In total, James Bennett’s “reward” for nearly destroying the company was almost $70 million or approximately 14% of the current market capitalization of SandRidge. we do not believe the incumbent directors may simply hide behind “business judgment” to explain away this corporate waste but rather should be required to demonstrate how their actions do not constitute gross negligence or a breach of the duties they owe to sandridge and its stockholders.

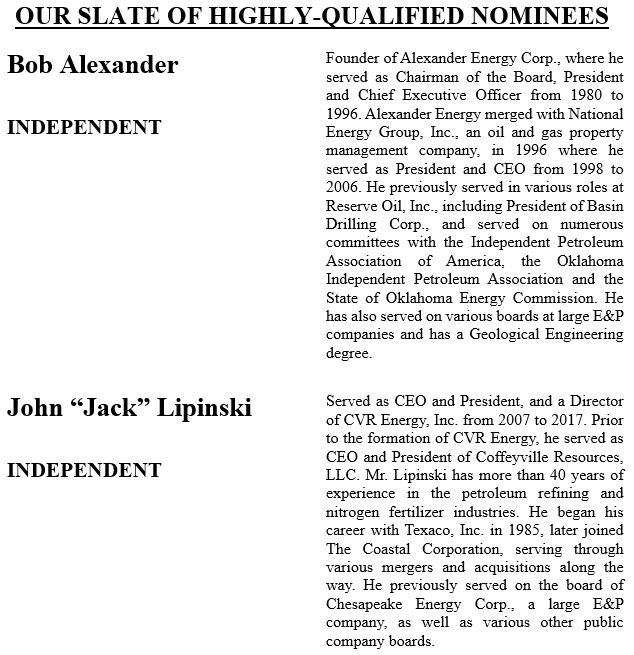

We believe the actions outlined above demonstrate what little regard the board has for stockholders. The owners of SandRidge must act NOW to take back control of their company. The choice is yours. You can vote for the incumbent directors on management’s slate, who we believe have already proved they are acting in the grand tradition of the previous managements and boards of SandRidge – that is, disregarding the interests of stockholders at every turn – or you can VOTE FOR CHANGE by electing our slate of highly-qualified nominees.

The incumbent directors are reminiscent of Keystone Cops with one discernible skill: they have proven to be quite adept at delivering extravagant stockholder-funded gifts to bankers and lawyers for advising on failed deals and concocting devilish schemes to disenfranchise the company’s owners and to former executives for driving SandRidge into bankruptcy and erasing billions of dollars in equity value. we believe these directors can and should be called to task for countenancing such highly questionable payments.

We, on the other hand, have created hundreds of billions of dollars of value for stockholders over the last 30 years by convincing boards and CEOs to take the steps necessary to greatly increase the value of their companies. Several well-known examples include Texaco, RJR Nabisco, Kerr-McGee, Time Warner, Motorola, ImClone, eBay, Forest Labs and National Energy Group, as well as many others. Unfortunately, it often took years for management and the boards of those companies to agree that we were correct. However, the current situation at SandRidge is too time-sensitive to wait years, especially when every single stockholder with whom we have spoken believes management’s current plan (or lack thereof) is insufficient.

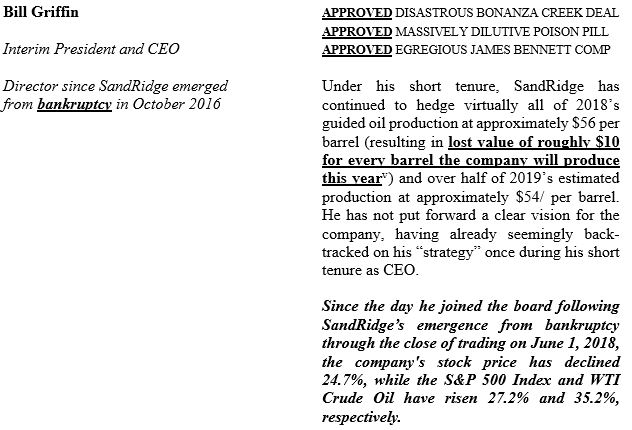

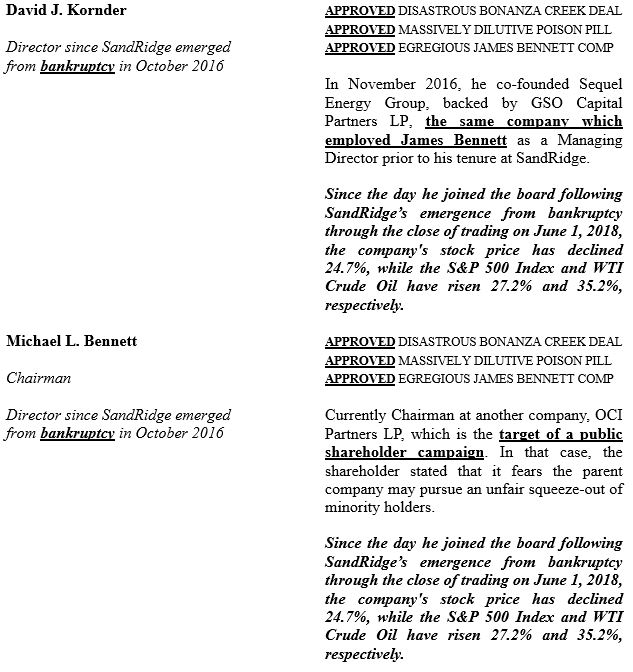

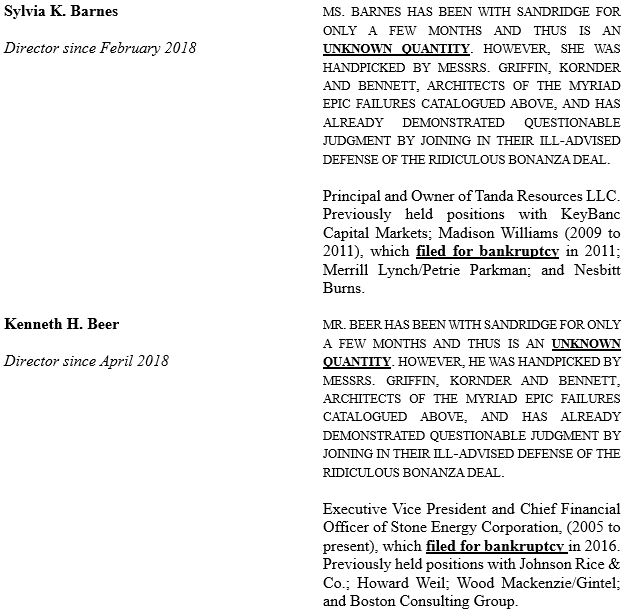

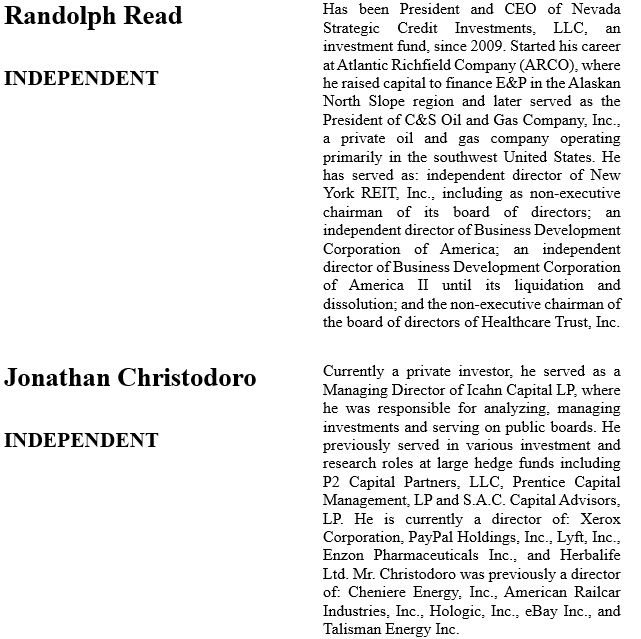

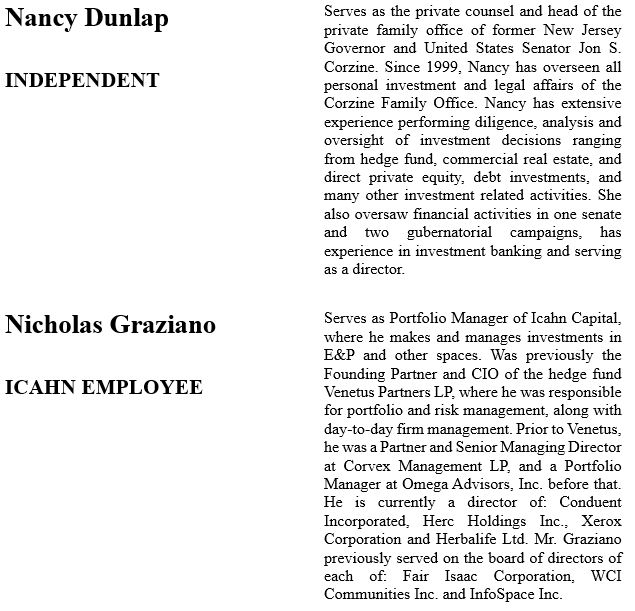

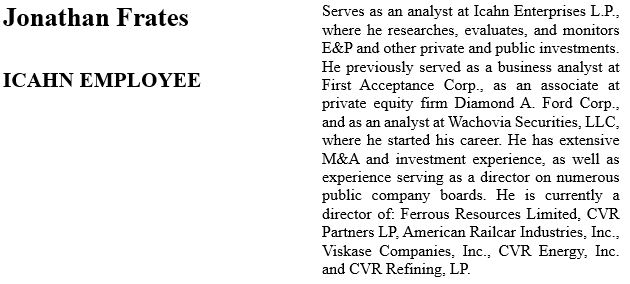

Compare the incumbent director slate to our slate of highly-qualified nominees.

THERE IS NO COMPARISON

THE INCUMBENT SLATE

Collectively, the incumbent directors (together with the named executive officers of the company) hold less than 1% of the outstanding shares of common stock of SandRidge, which tells us all we need to know about the confidence they place in their own abilities to right this sinking ship.

The choice is yours. Do you wish to allow the current board to run your investment in SandRidge? We certainly do not. After our experience with these directors and judging how they have disregarded the interests of stockholders, we do not trust them and want absolutely nothing to do with them. The company’s representatives have reached out to us on numerous occasions offering us minority representation on the board, but we have advised them in no uncertain terms that the only satisfactory resolution of our differences will be the replacement of the entire board. We therefore urge you to rip up the company’s white card and vote our GOLD card –

- FOR OUR HIGHLY-QUALIFIED NOMINEES AS DIRECTORS RATHER THAN THE FAILED INCUMBENT BOARD

- AGAINST THE BOARD’S PROPOSAL TO ENTRENCH THEMSELVES BY RATIFYING AND EXTENDING THE MASSIVELY DILUTIVE POISON PILL

- AGAINST THE BOARD’S PROPOSAL TO APPROVE THE COMPANY’S EGREGIOUS EXECUTIVE COMPENSATION

We appreciate the support that has been expressed to date for the election of our nominees and urge all stockholders to vote for the election of our seven nominees for election to the board of directors of SandRidge Energy, Inc.

Sincerely yours,

Carl Icahn

*****

If you have any questions, please contact:

Harkins Kovler, LLC

Banks and Brokers Call: +1 (212) 468-5380

All Others Call Toll-Free: +1 (800) 339-9883

Email: sd@harkinskovler.com

Additional Information and Where to Find it;

Participants in the Solicitation

CARL C. ICAHN AND THE OTHER PARTICIPANTS IN SUCH PROXY SOLICITATION (TOGETHER, THE “PARTICIPANTS”) FILED A DEFINTIVE PROXY STATEMENT AND ACCOMPANYING GOLD PROXY CARD WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) TO BE USED TO SOLICIT PROXIES IN CONNECTION WITH THE 2018 ANNUAL MEETING OF STOCKHOLDERS OF SANDRIDGE ENERGY, INC (THE “ANNUAL MEETING”). SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY THE PARTICIPANTS IN CONNECTION WITH THE ANNUAL MEETING BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. THESE MATERIALS AND OTHER MATERIALS FILED BY THE PARTICIPANTS WITH THE SEC ARE AVAILABLE AT NO CHARGE AT THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE PROXY STATEMENT. EXCEPT AS OTHERWISE DISCLOSED IN THE PROXY STATEMENT, THE PARTICIPANTS HAVE NO INTEREST IN SANDRIDGE ENERGY, INC. OTHER THAN THROUGH THE BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0.001 PER SHARE, OF SANDRIDGE ENERGY, INC.

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS LETTER:

THIS LETTER CONTAINS OUR CURRENT VIEWS ON THE VALUE OF SANDRIDGE SECURITIES AND CERTAIN ACTIONS THAT SANDRIDGE’S BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. SANDRIDGE’S ACTUAL PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS.

WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS LETTER. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

THIS LETTER ALSO REFERENCES THE SIZE OF OUR RESPECTIVE CURRENT HOLDINGS OF SANDRIDGE SECURITIES RELATIVE TO OTHER HOLDERS OF SUCH SECURITIES. OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING SANDRIDGE WITHOUT UPDATING THIS LETTER OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this letter are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results to differ materially from the expectations set forth in this letter include, among other things, the factors identified in SandRidge’s public filings. Such forward-looking statements should therefore be construed in light of such factors, and the Participants are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

[i] See Lauren Silva Laughlin, It takes two, Reuters Breakingviews (November 27, 2017).

[ii] See Press Release, Fir Tree Partners Strongly Opposes SandRidge Energy’s Proposed Acquisition of Bonanza Creek Energy, Fir Tree Partners (November 20, 2017).

[iii] Based on the closing price following the announcement and the volume weighted average price of SandRidge stock over the 30 days preceding the transaction announcement on November 15, 2017.

[iv] SandRidge investor presentation filed May 29, 2018.

[v] Based on year to date spot WTI and NYMEX Strip pricing as of the date of this letter.