Carl C. Icahn Issues Open Letter to

Stockholders of Southwest Gas

.

Sunny Isles Beach, Florida, January 26, 2022 — Today, Carl C. Icahn released the following open letter to the stockholders of Southwest Gas Holdings, Inc. (NYSE: SWX).

______________________________________

.

.

.

Investor Contacts:

Harkins Kovler, LLC

Peter Harkins / Jordan Kovler

(212) 468-5390 / (212) 468-5384

[email protected] / [email protected]

.

.

.

CARL C. ICAHN

16690 Collins Avenue, Suite PH-1

Sunny Isles Beach, FL 33160

January 26, 2022

.

.

Dear Fellow SWX Stockholders:

We are writing with an update on our tender offer and commentary on management’s recent actions.

Today we announced that we have extended the expiration date and amended the structure of our tender offer in a manner that we believe allows us to close the offer prior to obtaining regulatory approvals. As a result, regardless of how many SWX shares are ultimately tendered to us, all shares tendered will be purchased at $75 per share. However, we have agreed to only be able to vote an aggregate of 24.9% of the outstanding shares (which includes the shares we currently hold). All shares that are tendered above this amount will be placed into one or more trusts and voted by, and in the sole discretion of, completely independent trustees. These trusts will be the record owner of the shares and the trustees will be subject to instructions in the trust agreements that will require all shares in the trusts to be voted by the trustees without any consultation with us. We have evaluated this structure extensively with our advisors and third parties and believe that it will obviate the need to obtain regulatory approval prior to the closing of our tender offer. Regulatory approvals may ultimately be required if we determine that we wish to own these shares directly. The process for obtaining these approvals would occur only after the closing of our offer and tendering stockholders have been paid.

The incumbent SWX board has claimed – falsely – that, because our acquisition of control of SWX will require regulatory approval, our offer is “highly illusory and it is very unlikely that stockholders will ever receive any offer consideration.” Today’s change takes that false claim completely off the table. Indeed, we find it amusing that SWX directors and management seem to be relying on regulators to save their jobs when the repeated admonishments of SWX by those same regulators seems to indicate that they will likely rejoice if there is a regime change at the Company.

Stockholders’ participation in our tender offer is currently being blocked by the egregious poison pill and other entrenchment devices enacted by the incumbent SWX directors to protect their jobs. Rather than allow stockholders to receive a significant premium (currently approximately $10 per share) for their shares, the incumbent board continues to hold them hostage to management’s poorly conceived plan (if one can even call a willy-nilly, debt-laden acquisition spree a plan), including the value destructive and counter-intuitive acquisition of Questar Pipelines. Therefore, to ensure that the removal of these impediments will be evaluated by conflict-free directors, we have added a condition to the offer requiring that at least a majority of our slate of nominees must be elected to the board at the upcoming 2022 annual meeting.

We have thus added a degree of certainty to our offer that even this board’s doublespeak cannot obfuscate. Indeed, following these changes, our offer contains far fewer conditions than most other tender offers (e.g., our offer is not subject to any due diligence or financing conditions). Additionally, we will no longer be constrained by the incumbent board’s onerous poison pill because we are highly optimistic that once our slate of highly qualified and independent directors is elected, they will work expeditiously to remove all impediments that are currently preventing stockholders from receiving a premium for their shares. It would be instructive to review the tender offer we launched in 2012 for the common shares of CVR Energy, along with a proxy contest to replace the incumbent board of CVR. The incumbent board and management of CVR were as disliked as the incumbent board and management of SWX now are. As in the case of the current SWX situation, CVR followed the standard playbook by arrogantly ignoring the will of stockholders and implementing a poison pill to protect their jobs and deny stockholders the right to choose for themselves whether they wished to accept our tender offer and receive a high premium for their shares. But when stockholders overwhelmingly tendered, indicating their intention to vote in a new board that would remove the pill, thereby allowing the Icahn group to purchase their stock at a high premium, the incumbents resigned rather than almost certainly losing in the proxy contest. Significantly, the resigning incumbents were granted releases against lawsuits. We believe the SWX board and management would similarly resign if a large percentage of shares were tendered. We cannot help but believe that releases might prove to be very desirable and useful to the SWX board and management based on our review of their past negligent actions.

We encourage all stockholders who are interested in accepting our offer to tender NOW to send a clear message to the incumbent SWX directors that stockholders will no longer abide their self-interested defensive tactics. Stockholders are always free to withdraw their shares at any time prior to the expiration of our offer.And for those stockholders who wish to be aligned with us and maintain an interest in a new SWX that will work assiduously to repair the fractured relationships that the incumbent board has fostered with regulators and customers alike, we welcome your support and encourage you to voice your opinions at the upcoming annual meeting. We believe that not only will continuing stockholders see the value of their investment in SWX significantly enhanced following a successful tender, but customers will also benefit greatly from a more accountable management team, less corporate waste, a renewed focus on the utility and a monetization of the services division and the ill-advised Questar asset.

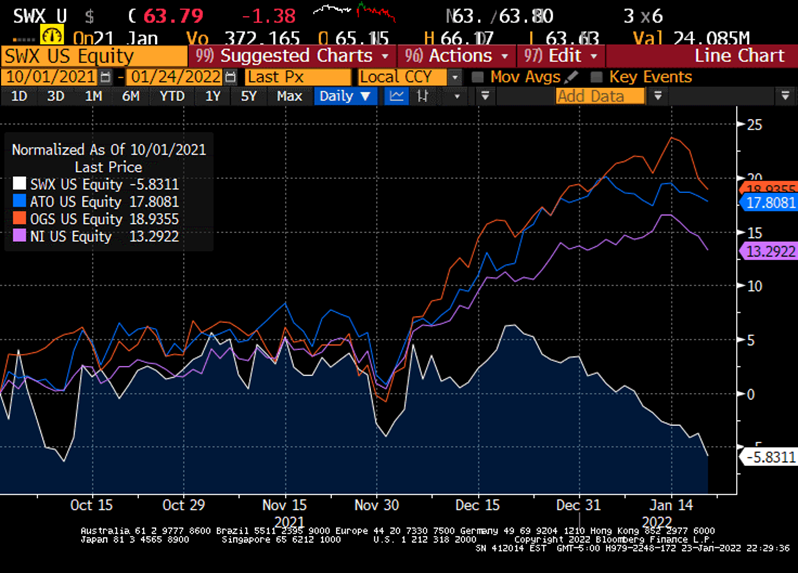

Stockholders are emphatically voting “NO” on management’s plan through continued share price underperformance. As you can see from the below chart, SWX has underperformed as compared to its natural gas utility peers by ~20% since October 1, 2021 (the Friday prior to the date on which the Questar Pipelines deal was leaked).

We view these developments as an inevitable march to the installment of a new board with a value-enhancing and responsible business plan. We encourage all stockholders to voice their displeasure to SWX’s management, to participate in our tender offer and, in due course, to vote for the election of our highly qualified director nominees. We are hopeful that SWX will allow stockholders to decide their own fate without the interference of board-imposed entrenchment devices.

Sincerely yours,

.

Carl C. Icahn

.

.

.

Additional Information and Where to Find It;

Participants in the Solicitation and Notice to Investors

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. (“SOUTHWEST GAS”) FOR USE AT THE ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF SOUTHWEST GAS AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S (“SEC”) WEBSITE AT HTTPS://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY CARL C. ICAHN AND HIS AFFILIATES WITH THE SECURITES AND EXCHANGE COMMISSION ON DECEMBER 15, 2021. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN SOUTHWEST GAS. THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS.

THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES. IEP UTILITY HOLDINGS LLC, AN AFFILIATE OF ICAHN ENTERPRISES, FILED A TENDER OFFER STATEMENT AND RELATED EXHIBITS WITH THE SEC ON OCTOBER 27, 2021. SOUTHWEST GAS FILED A SOLICITATION/ RECOMMENDATION STATEMENT WITH RESPECT TO THE TENDER OFFER WITH THE SEC ON NOVEMBER 9, 2021. STOCKHOLDERS OF SOUTHWEST GAS ARE STRONGLY ADVISED TO READ THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS THEY MAY BE AMENDED FROM TIME TO TIME, BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE TENDER OFFER STATEMENT AND OTHER DOCUMENTS THAT ARE FILED BY IEP UTLITY HOLDINGS LLC WITH THE SEC WILL BE MADE AVAILABLE TO ALL STOCKHOLDERS OF SOUTHWEST GAS FREE OF CHARGE UPON REQUEST TO THE INFORMATION AGENT FOR THE TENDER OFFER. THE INFORMATION AGENT FOR THE TENDER OFFER IS HARKINS KOVLER, LLC, 3 COLUMBUS CIRCLE, 15TH FLOOR, NEW YORK, NY 10019, TOLL-FREE TELEPHONE: +1 (800) 326-5997, EMAIL: [email protected].

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS LETTER:

WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS LETTER. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING SOUTHWEST GAS WITHOUT UPDATING THIS LETTER OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Important factors that could cause actual results to differ materially from the expectations set forth in this letter include, among other things, the factors identified in Southwest Gas’ public filings. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.