Carl C. Icahn Issues Open Letter to

Stockholders of Southwest Gas

Sunny Isles Beach, Florida, April 11, 2022 — Today, Carl C. Icahn released the following open letter to the stockholders of Southwest Gas Holdings, Inc. (NYSE: SWX).

.

.

______________________________________

.

.

Investor Contacts:

Harkins Kovler, LLC

Peter Harkins / Jordan Kovler

(212) 468-5390 / (212) 468-5384

[email protected] / [email protected]

.

.

.

CARL C. ICAHN

16690 Collins Avenue, Suite PH-1

Sunny Isles Beach, FL 33160

April 11, 2022

Dear Fellow SWX Stockholders:

There exists today many problems at SWX, which the company is now desperately trying to obfuscate. However, the company’s abysmal track record since CEO John Hester took over in 2015 can’t be covered up. During this period, SWX has underperformed its natural gas utility peers by 72% and utility general and administrative expenses grew 42% from 2015 to 2020. The incumbent board of directors and management hardly seem to care and partied on. According to testimony from the Nevada Public Utility Commission, they amazingly tried to spend not only stockholders’ money but also customers’ money at a prodigious rate on a million-dollar home, golf memberships, extravagant CEO office furniture and pedicures. Additionally, if discovery were ever taken in litigation, one can only imagine what else would be found. CEO John Hester is a serial acquirer of companies who relishes paying top dollar for non-synergistic assets in competitive auctions while allowing his core asset – the utility – to underearn and expenses to balloon. Until we came along six months ago, the incumbent board of directors didn’t seem to care. This is almost understandable given the fact that the entire incumbent board and management team own less than 1% of the company. SWX, because management believes they are accountable to no one, has heretofore operated like a totalitarian state rather than a democracy. True to form, the company is now spewing forth to its citizens (stockholders) one falsehood after another. But unlike a dictatorship, we have the ability to show how irrational and false their propaganda is. The following is an in-depth dissection of the many falsehoods in SWX’s last letter published on April 7th.

- SWX False Statement: “Your Board and management team have taken decisive action to deliver stockholder value”

o THE TRUTH: SWX’s board and management team have pursued a value-destructive acquisition spree, paying top dollar for assets to empire build and entrench and enrich themselves. Their financing mechanisms have been reckless. Rarely do utilities pursue $855 million acquisitions of non-regulated assets financed entirely with debt. Rarely do companies finance with 100% short-term debt an acquisition that represents ~50% of their own company’s market capitalization – thus putting themselves in the untenable position of being forced to issue significant equity at some uncertain date and uncertain price without a stockholder vote. Many would call these activities “grossly negligent.”

- SWX False Statement: “Mr. Icahn is intent on capturing the value of Southwest Gas for himself, and no one else.”

o THE TRUTH: We believe strongly in the potential of Southwest Gas under a new board of directors. That is why we have launched a tender offer to buy any and all shares of SWX at $82.50 per share. The tender is there for those who wish to decide for themselves whether $82.50 is an attractive premium compared to the $64.92 closing price on the day prior to our initial tender offer. The tender offer is a choice. If you believe in the long-term value creation plan (like we do) you are welcome to hold your shares and participate alongside us as our nominees to the SWX board of directors generate long-term value. We welcome the opportunity to partner with you as we have in many other companies.

- SWX False Statement: “The fact that MountainWest was not managed as a core asset under prior ownership also presented an opportunity for us to unlock further value through focused management as a core strategic component of Southwest Gas”

o THE TRUTH: How ironic is it that SWX’s directors want to have “focused management” of a non-core asset that SWX did not need to buy (and stockholders did not want them to buy) when SWX already had a core asset that is poorly performing and receives minimal attention from management?!

- SWX False Statement: “We paid a fair price for MountainWest”

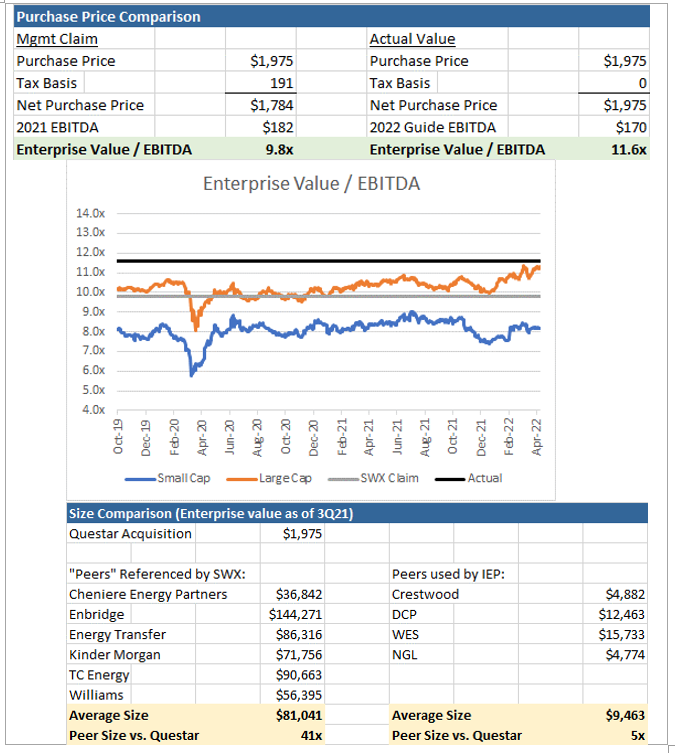

o THE TRUTH: SWX management claims they purchased Questar at 9.8x EV/E. We believe they actually paid 11.6x! The 11.6x EV/E multiple is 45% higher than a more accurate peer average. The difference in purchase price multiple is two-fold: the EBITDA metric should be the most recent EBITDA (2022) instead of the old EBITDA (2021); and it is misleading to reduce the transaction value by the basis step-up. SWX used 2021 EBITDA of $182 million in its presentation announcing the Questar deal but then guided 2022 EBITDA to only $170 million. The 7% decline happened in just a few months from 10/5/21 to 3/1/22. We are not sure whether SWX’s diligence process was flawed or if they hid the real number so that the deal would appear cheaper (or perhaps both). SWX’s presentation compares their highly optimistic view of the purchase price vs. a comp set of best-in-class mega caps (that were not adjusted for tax). The reality is that Questar is a small asset that is shrinking and should not be compared to mega caps that grow. A better comp set is, at a minimum, smaller companies – and those had an average EV/E of 8x (from 10/1/19 to 4/8/22).

o We are not the only ones who believe that SWX overpaid. Bank of America’s base case valuation for Questar is $1.365 billion (31% lower than the purchase price, according to the Bank of America report dated 03/30/22). Wells Fargo’s valuation is $1.6 billion (19% lower than purchase price, according to the Wells Fargo report dated 04/07/22).

- SWX False Statement: “We are on track with the integration of MountainWest and are already benefitting from strong operating cash flows from the acquisition”

o THE TRUTH: SWX’s stated 2021 EBITDA expectations for Questar were $182 million and it was praised as “highly contracted” and “stable.” Yet between the acquisition announcement (10/5/21) and guidance issuance (03/01/22), EBITDA expectations fell from $182 million to $170 million or 7%?! This appears to be either a failure in diligence or was a disguise to attempt to show that the acquisition was cheaper than what was really expected (or perhaps both).

- SWX False Statement: “Mr. Icahn’s claims that (i) Southwest Gas is an outlier in now owning an attractive and adjacent FERC-regulated business and (ii) all industry participants are pursuing divestiture strategies to be only regulated utilities are factually incorrect.”

o THE TRUTH: We never said all utilities are selling all of their midstream assets. We did say that no other utilities are actively buying midstream assets. In fact, Dominion, DTE, ConEd, OGE, CenterPoint and NextEra all recently sold all or some of their midstream assets. SWX is the only utility buyer of midstream assets.

- SWX False Statement: “MountainWest positions Southwest Gas to explore and deliver on numerous attractive opportunities in renewable natural gas, responsibly sourced natural gas, hydrogen and CO2 transportation”

o THE TRUTH: If SWX management wanted to invest in the energy transition they would have invested in their own backyard. Renewable natural gas is best sourced from landfills (located near population centers) and agricultural waste. Arizona, California, and Nevada have larger populations, and Arizona and California have significantly more farms than Wyoming and Utah. Green hydrogen relies on low-cost electricity to use electrolyzers to create hydrogen. The lowest cost electricity is typically stranded renewables and Arizona, Southern California and Nevada are perfect candidates given the desert climate. CO2 transportation/storage/capture are best suited in areas with significant industrial production and with depleted oil & gas fields for storage (e.g., Gulf Coast).

- SWX False Statement: “We have identified numerous opportunities to enhance the value of the MountainWest assets and to foster growth”

o THE TRUTH: Has the SWX incumbent board of directors performed diligence on the Overthrust Pipeline? As we understand, FERC-regulated natural gas pipelines are not supposed to earn 30% ROEs over the long run. We expect that Overthrust will someday go through a rate case and earnings could be reset to a ~10% ROE, which would cause a $30 million drop in EBITDA (an 18% hit to 2022 EBITDA guidance of $170 million). If you combine declining natural gas production in the Pinedale and Piceance basins with a pending reset of Overthrust earnings, there is far more downside risk than upside to Questar EBITDA. There is a reason that synergistic buyers would not bid higher than $1.7 billion!

- SWX False Statement: “Your [incumbent] SWX Board and management team have the plan and skills to grow Southwest Gas through the energy transition. Mr. Icahn does not”

o THE TRUTH: We are no stranger to the energy transition. We have invested ~$200 million in renewable diesel units at CVR Energy Inc. We were a significant investor in Occidental Petroleum, a company that is building one of the largest carbon capture businesses in the U.S. We are a significant investor in Cheniere Energy, a company that is the largest exporter of natural gas in the U.S. We have also recruited a highly independent, experienced, and qualified slate of nominees who have served as utility executives and regulators who are well suited to lead SWX through the energy transition.

- SWX False Statement: “Time and time again we have stated that the equity offering was completed well after the March 21, 2022, record date had passed. As such, none of the shares issued in the financing will have voting rights at the Annual Meeting.”

o THE TRUTH: As currently stands, both parties agree that the newly issued shares will not be able to vote. That said, SWX is insulting our intelligence by failing to address the key issue. If SWX decides to move the record date in the future, or if they move the meeting date in a way that requires moving the record date, then the newly issued shares WILL be entitled to vote. We continue to ask whether SWX will commit to NOT moving the record date or moving the meeting date in a way that necessitates moving the record date – but, tellingly, they refuse to answer. This clearly means to us that SWX is reserving the right to move the record date should they need to do so to manufacture an artificial victory and deprive stockholders of a fair election process.

- SWX False Statement: “Mr. Icahn made his illusory offer [to purchase all the shares at $82.50 per share] only after the Company announced the commencement of the public offering of common stock”

o THE TRUTH: We made a public proposal on March 1st answering SWX’s overpaid investment banker’s “questionnaire,” wherein we reiterated once again that we were willing to pay $75 per share and would be willing to beat any bona fide offer. We never once received a counteroffer or even a call back. Even though SWX claims it has raised equity at $74 per share, the reality is that, after expenses, SWX actually raised equity at only $71.50 per share. It is unclear how $71.50 per share price is superior in any way to $75 per share, let alone the $82.50 per share that we publicly offered well in advance of the pricing of this recent offering.

- SWX False Statement: “Mr. Icahn also failed to mention it would be illegal for Mr. Icahn to buy shares of Southwest Gas in a financing in light of pending tender offer”

o THE TRUTH: The tender offer contains a condition allowing us to withdraw the offer if SWX pursues any equity financing that is not offered pro-rata to all existing stockholders. The recent public equity offering clearly triggered that condition and would have allowed the tender offer to be withdrawn. We could then have acquired the shares at a 15% premium to the price SWX received after fees. We could then have relaunched the tender offer.

- SWX False Statement: “Mr. Icahn said he is nominating 10 candidates in support of his efforts to take control of the Company for $82.50 per share.”

o THE TRUTH: We have nominated a slate of ten directors to replace SWX’s incumbent board of directors, who believe in entrenchment and self-enrichment at the expense of SWX’s stockholders and customers. Eight of the ten directors are entirely independent of IEP. These eight individuals have no voting agreements, no compensation packages, no overlapping boards, and no overlapping work history with IEP. All ten directors will serve as fiduciaries to the company. The tender offer is a choice. Stockholders should have the right to decide for themselves whether or not they want to participate in the tender offer. Unfortunately, SWX’s incumbent board of directors have decided that stockholders should not have the right to choose their own outcomes.

- SWX False Statement: “Your Board believes the Company is worth more than $82.50”

o THE TRUTH: If the board actually believed that SWX was worth more than $82.50 per share then why was the company selling shares in the $60s as recently as September 2021 and why did SWX just sell shares at an effective price of $71.50 per share to finance the ill-advised Questar deal?

The incumbent SWX directors are relying on the fact that they, as members of a utility board of directors, can’t be replaced basically because it has never been done before. But if the directors of a utility have broken their regulatory compact and upset their stockholders, their customers, and their regulators, they should be treated no differently than the directors of any other poorly performing company.

The vote on May 12th gives stockholders a choice to help all the company’s stakeholders – except, perhaps, the incumbent board of directors. The choice is clear and we urge all stockholders to vote FOR our slate of highly qualified and independent directors to put SWX on a new path.

Sincerely yours,

.

.

.

Carl C. Icahn

Additional Information and Where to Find It;

Participants in the Solicitation and Notice to Investors

THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. CARL C. ICAHN AND HIS AFFILIATES HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, AND MAILED TO THE STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. A DEFINITIVE PROXY STATEMENT AND A GOLD PROXY CARD IN CONNECTION WITH THEIR SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. ARE ADVISED TO READ THE PROXY STATEMENT AND RELATED MATERIALS CAREFULLY, AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATED TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION.

COPIES OF THE DEFINITIVE PROXY STATEMENT AND GOLD PROXY CARD ARE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY CARL C. ICAHN AND HIS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 28, 2022.

THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES. IEP UTILITY HOLDINGS LLC, AN AFFILIATE OF ICAHN ENTERPRISES, FILED A TENDER OFFER STATEMENT AND RELATED EXHIBITS WITH THE SEC ON OCTOBER 27, 2021. SOUTHWEST GAS FILED A SOLICITATION/ RECOMMENDATION STATEMENT WITH RESPECT TO THE TENDER OFFER WITH THE SEC ON NOVEMBER 9, 2021. STOCKHOLDERS OF SOUTHWEST GAS ARE STRONGLY ADVISED TO READ THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS THEY MAY BE AMENDED FROM TIME TO TIME, BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE TENDER OFFER STATEMENT AND OTHER DOCUMENTS THAT ARE FILED BY IEP UTLITY HOLDINGS LLC WITH THE SEC WILL BE MADE AVAILABLE TO ALL STOCKHOLDERS OF SOUTHWEST GAS FREE OF CHARGE UPON REQUEST TO THE INFORMATION AGENT FOR THE TENDER OFFER. THE INFORMATION AGENT FOR THE TENDER OFFER IS HARKINS KOVLER, LLC, 3 COLUMBUS CIRCLE, 15TH FLOOR, NEW YORK, NY 10019, TOLL-FREE TELEPHONE: +1 (800) 326-5997, EMAIL: [email protected].

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS LETTER:

THIS LETTER CONTAINS OUR CURRENT VIEWS ON THE VALUE OF SOUTHWEST GAS SECURITIES AND CERTAIN ACTIONS THAT SOUTHWEST GAS’ BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. SOUTHWEST GAS’ PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS.

WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS LETTER. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING SOUTHWEST GAS WITHOUT UPDATING THIS LETTER OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this letter are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results to differ materially from the expectations set forth in this letter include, among other things, the factors identified in Southwest Gas’ public filings. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.