Contact:

Icahn Capital LP

Susan Gordon

(305) 422-4109

Carl C. Icahn Issues Open Letter to

Board of Directors of Southwest Gas

Sunny Isles Beach, Florida, October 5, 2021 — Today, Carl C. Icahn released the following open letter to the board of directors of Southwest Gas Holdings, Inc. (NYSE: SWX).

______________________________________

CARL C. ICAHN

16690 Collins Avenue, Suite PH-1

Sunny Isles Beach, FL 33160

October 4, 2021

Southwest Gas Holdings, Inc.

8360 S. Durango Drive

Las Vegas, NV 89113

Attention: Board of Directors

.

.

.

Ladies and Gentlemen:

During the past few years, management of SWX has made a number of egregious errors at the expense of shareholders. However, the purchase of Questar you are currently being rumored to make at the price you are willing to pay will make all past errors pale in comparison. The purchase will result in serious diminution of shareholder value.

It also appears that other shareholders agree with our assessment, given the 7.5% price decline this morning – an amazing and unusual decline for a regulated utility.

We tried to reach you last night and today but to no avail. We ask you to immediately tell shareholders if the Reuters report is factual.

As a large shareholder, we are extremely disappointed with management’s performance over the past few years. The following is a summary of why:

Industry Oddity

SWX has pursued a strategy of acquiring non-regulated assets while other utilities have sold non-core assets to focus primarily on regulated utility operations, suggesting to us that the Board has not provided the proper oversight with respect to strategic M&A. The rumored acquisition of the Questar Pipeline is yet another dramatic example of this oversight failure. While this deal would be for a regulated asset, it appears that you are inexplicably paying 2x rate base while your own company trades at 1x (after adjusting for the value of the services division). But even if you were not overpaying, this is no time for management with the many problems you have (including with regulators) to embark on a major new investment especially when you have shown an inability to manage and control what you already own.

Debilitated Relationship with Regulators

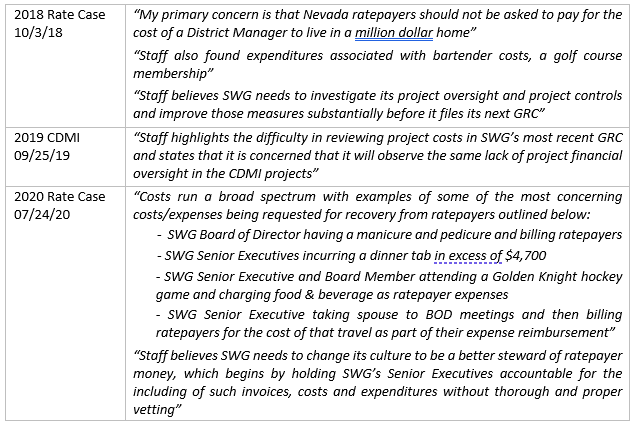

Inappropriate expenses and disregard for Nevada regulators have led to disallowed expenses, denied trackers in multiple states and impaired relationships over a multi-year time period. The Nevada PUC staff says it best:

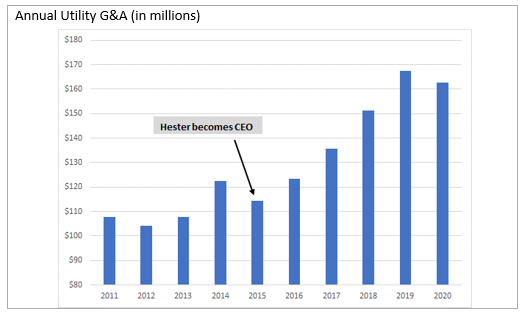

Runaway Expenses

G&A increased materially beginning in 2016. Some expense increases are likely warranted but how many million-dollar homes, manicures, golf course memberships and boozy dinners are hidden in G&A? In any case, the damage already inflicted by the broken trust with regulators is immeasurable. Loss of trust with regulators is extremely damaging to both shareholders and ratepayers.

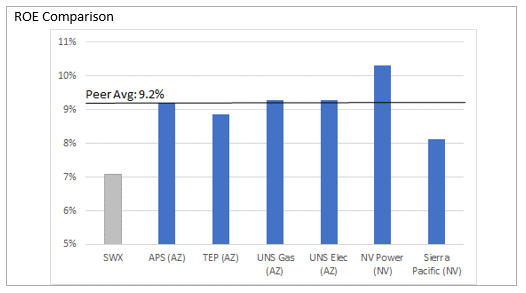

Depressed Utility ROE:

A strained relationship with regulators and increasing G&A have led to a depressed 7.1% ROE. This is materially lower than both its 9.4% allowed ROE and the average 9.2% ROE achieved by utility peers in AZ and NV.

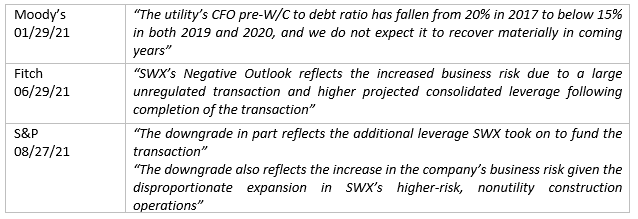

Weakened Credit Profile

The combination of M&A and a depressed ROE have led to a deteriorating credit profile.

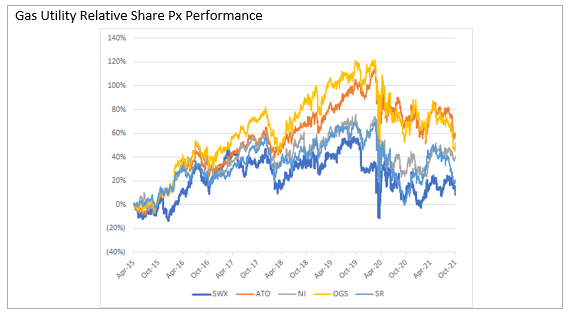

Laggard Shareholder Returns

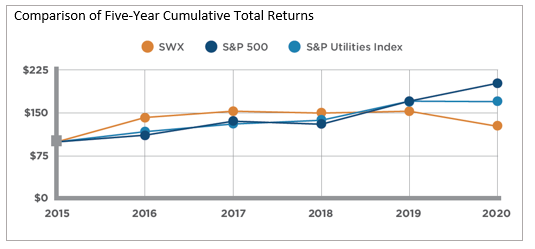

SWX significantly underperformed its regulated gas utility peers since April 2015:

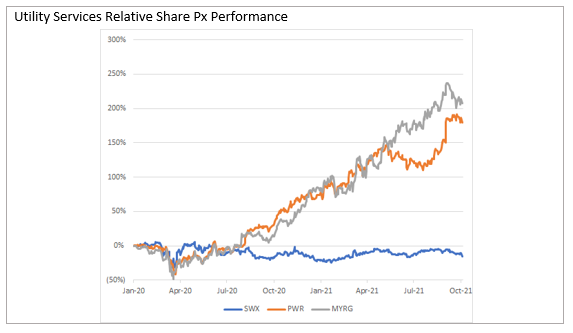

The underperformance is even worse considering the recent performance of peer utility services companies (Quanta and MYR Group).

Even when using the chart in the company’s own investor presentation, SWX materially underperformed peers.

Increasing Compensation While Underperforming

Named Executive Officer compensation increased 25% in 2019 and 27% in 2020 while the company underperformed the S&P Utilities Index by 24% and 18% respectively.

Poor Governance

Seven of the nine “Independent” Directors have served on the Board for an average of 13 years (going on 14). The Chairman has served as a Director for almost 20 years. Stagnant boards often fail to implement changes, ask tough questions, and hold management accountable.

Value Creation Opportunity

For all the above reasons, we believe a significant opportunity exists for both ratepayers and shareholders by improving management accountability.

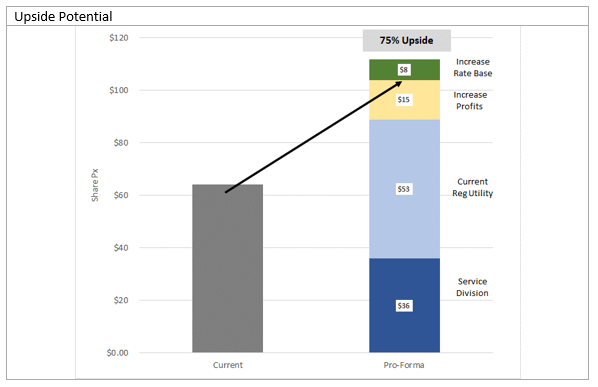

Currently SWX trades at ~$63 per share. We could see a reasonable path to ~75% value appreciation. We could further argue for more upside given SWX’s industry leading customer growth and a modernized pipeline system (e.g. largely plastic) that is well-suited for the transition to hydrogen.

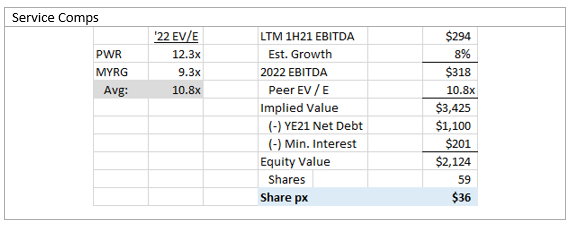

The services business alone could be worth $36 per share considering the two most comparable peers trade at an average EV / 2022 EBITDA of 10.8x.

The status quo regulated utility (which we believe can be materially improved) could be worth $53 per share as relevant comps trade at 17.5x 2021 P/E.

With respect to potential incremental improvements, we assume that improving the cost structure and repairing regulatory relationships would allow the ROE to increase to allowed levels and could be worth $15 per share. Furthermore, we think a repaired working relationship with regulators would allow for the COYL/VSP/CDMI projects to be correctly included in the rate base, which could be worth another $8 per share.

Given the combination of these opportunities, we believe shareholders could realize ~75% appreciation in value per share.

We urge you to reach out to us as soon as possible to discuss this letter. You may reach me through my assistant, Susan Gordon, at (305) 422-4109 or [email protected].

Sincerely yours,

.

.

Carl C. Icahn

.

.

.

.

.

Additional Information and Where to Find it;

Participants in the Solicitation

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC (“SOUTHWEST GAS”). USE AT THE ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF SOUTHWEST GAS AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY CARL C. ICAHN AND HIS AFFILIATES WITH THE SECURITES AND EXCHANGE COMMISSION ON OCTOBER 5, 2021. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN SOUTHWEST GAS.

THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION OF PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS.

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS LETTER:

THIS LETTER CONTAINS OUR CURRENT VIEWS ON THE VALUE OF SOUTHWEST GAS SECURITIES AND CERTAIN ACTIONS THAT SOUTHWEST GAS’ BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. SOUTHWEST GAS’ PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS.

THIS LETTER ALSO REFERENCES THE SIZE OF OUR RESPECTIVE CURRENT HOLDINGS OF SOUTHWEST GAS SECURITIES. OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING SOUTHWEST GAS WITHOUT UPDATING THIS LETTER OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this letter are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results to differ materially from the expectations set forth in this letter include, among other things, the factors identified in Southwest Gas’ public filings. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.