Carl C. Icahn Issues Open Letter to

Shareholders of Illumina, Inc.

Sunny Isles Beach, Florida, May 11, 2023 — Today, Carl C. Icahn released the following open letter to the shareholders of Illumina, Inc. (NASDAQ: ILMN).

______________________________________

Glass Lewis Recommends AGAINST CEO Francis deSouza

Glass Lewis Recommends AGAINST Chair John Thompson

Glass Lewis Recommends FOR Two Icahn Nominees

______________________________________

.

.

Investor Contacts:

HKL & Co., LLC

Peter Harkins / Jordan Kovler

(212) 468-5390 / (212) 468-5384

[email protected] / [email protected]

.

.

CARL C. ICAHN

16690 Collins Avenue, Suite PH-1

Sunny Isles Beach, FL 33160

May 11, 2023

Dear Fellow Illumina Shareholders:

Yesterday, proxy advisory firm Glass Lewis released their recommendations for the upcoming Illumina annual meeting. We enthusiastically agree with many of their key points, most importantly that shareholders vote AGAINST CEO Francis deSouza and AGAINST Chair John Thompson. Glass Lewis also recommends that shareholders vote FOR Icahn Nominees Andrew Teno and Vincent Intrieri. Shareholders seem to have agreed with Glass Lewis’ recommendations, sending shares +8% on the day. We encourage the incumbent board of directors to go to a quiet room, read the thoughtful and well-reasoned report and thoroughly question the failed leadership from CEO Francis deSouza and Chair John Thompson. We believe the report speaks for itself:

“[W]e believe Icahn submits more compelling reasoning around a number of other key issues, including the Company’s legacy and guided operating performance under CEO Francis deSouza, questionable aspects of Illumina’s corporate governance architecture, the board’s general oversight efficacy and, ultimately, the Company’s poor shareholder returns profile, particularly in the wake of the GRAIL transaction. In view of these material concerns, we are inclined to suggest investors support two Icahn nominees – and, critically, withhold support from Messrs. deSouza and Thompson – at this time.”

“[W]e believe the overarching dissenting thesis – i.e. that closure of the GRAIL acquisition against the express perspectives and ultimate prohibitions of major US and EU regulators represented a decidedly atypical transactional methodology and a questionable adjudication of risk on behalf of Illumina investors – carries the day here.”

“Against this backdrop, it is important, in our view, to circle back to a fundamental concept underpinning the current contest: the foregoing costs, risks and uncertainties exist entirely because the board took the exceptional step of closing the GRAIL transaction against the express wishes of two powerful antitrust regulators.”

“We further believe Icahn fairly argues that, despite the presence of this self-made boondoggle, the board appears decidedly and disconcertingly disinclined to accept any clear responsibility, laying fault principally with major regulators with which the Company willfully locked horns, while concurrently affording Mr. deSouza what we consider to be substantially misaligned compensation.”

“Separate entirely from the GRAIL quagmire, we would circle back to Illumina’s comparatively poor performance throughout Mr. deSouza’s tenure. That arc notably includes middling revenue growth and deteriorating margins within the Company’s core business, as well as pro forma cost guidance which appears to have inspired little market confidence.”

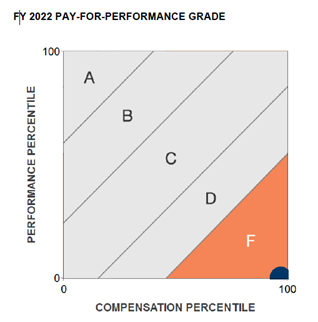

“Perhaps most concerning – and as discussed further in our analysis of Proposal 3 and within our summary Pay-for-Performance grading commentary – we find Illumina’s pay program has continued to result in a clear decoupling of compensation from operational results and shareholders returns, with the Company receiving P4P grades of D, F and F for FY2020, FY2021 and FY2022, respectively. Furthermore, it is worth noting the F grade associated with the most recent fiscal year not only manages to be worse than Illumina’s objectively poor FY2021 result, it very nearly achieves the worst position possible within our analytical framework.”

“…notwithstanding the relative rarity of such a challenge to key incumbents, we believe investors should contemporaneously withhold votes from Illumina candidates deSouza and Thompson. Our recommendation in this regard certainly reflects unease surrounding Illumina’s operating performance, value creation and overall corporate governance, but is foundationally underpinned by our substantial concerns with GRAIL, up to and including a current tone and tenor which implies the board believes investors should be satisfied with a lengthy, expensive, and potentially still heavily damaging appeals process. Under these conditions, we would reinforce our view that investors have ample cause to hold the incumbent board, including CEO Francis deSouza and board chair John Thompson, directly accountable for the myriad risks, costs and uncertainties which continue to be associated with Illumina’s questionable determination to close the GRAIL transaction.”

We commend Glass Lewis for its decision. In rejecting CEO Francis deSouza and Chairman John Thompson, they urge change. They have rightfully identified two Icahn candidates with the requisite skills to act for the good of ALL Illumina shareholders, employees and customers.

Sincerely yours,

.

.

Carl C. Icahn

______________________________________

.

Additional Information and Where to Find It;

Participants in the Solicitation and Notice to Investors

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE SHAREHOLDERS OF ILLUMINA, INC. (“ILLUMINA”) FOR USE AT ITS 2023 ANNUAL MEETING OF SHAREHOLDERS BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY HAS BEEN MAILED TO SHAREHOLDERS OF ILLUMINA AND ARE ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE DEFINITIVE PROXY STATEMENT FILED BY CARL C. ICAHN AND HIS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 27, 2023. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN ILLUMINA.

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS COMMUNICATION:

THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES.

THIS COMMUNICATION CONTAINS OUR CURRENT VIEWS ON THE VALUE OF ILLUMINA SECURITIES AND CERTAIN ACTIONS THAT ILLUMINA’S BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. ILLUMINA’S PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS.

WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS COMMUNICATION. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING ILLUMINA WITHOUT UPDATING THIS COMMUNICATION OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this communication are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results to differ materially from the expectations set forth in this communication include, among other things, the factors identified in Illumina’s public filings. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.