ALL RECIPIENTS ARE ADVISED TO READ

“IMPORTANT DISCLOSURE INFORMATION”

AT THE END OF THE ATTACHED LETTER

CARL C. ICAHN

767 Fifth Avenue, 47th Floor

New York, New York 10153

February 11, 2015

Dear Twitter Followers:

We were pleased to hear Tim Cook yesterday state publicly: “By and large, my view is, for cash that we don’t need – with some level of buffer – we want to give it back [to shareholders]. It may come across that we are, but we’re not hoarders.” This position with respect to excess cash is great news for shareholders, and we look forward to the capital return program update in April, anticipating it will include a large increase to share repurchases.

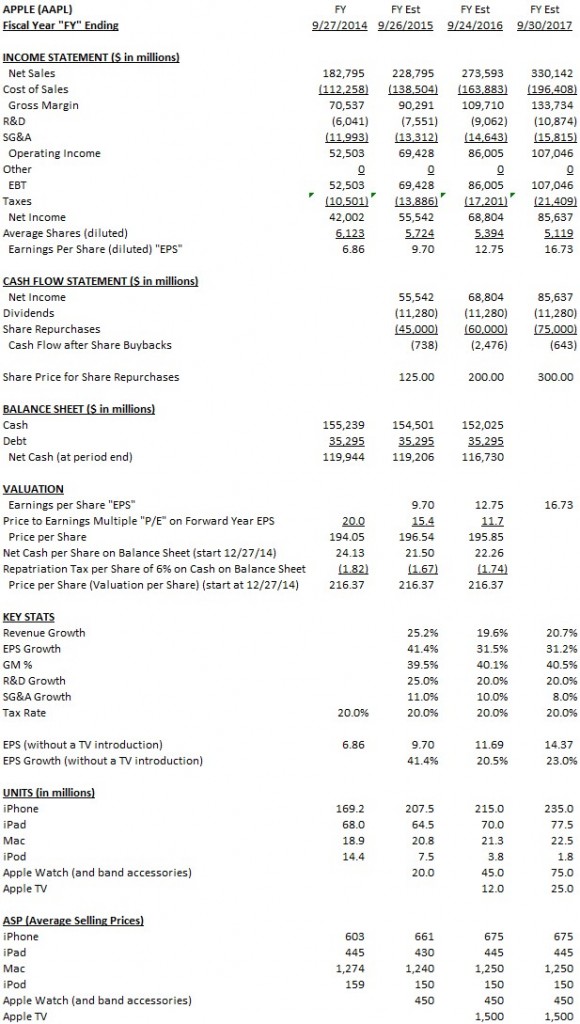

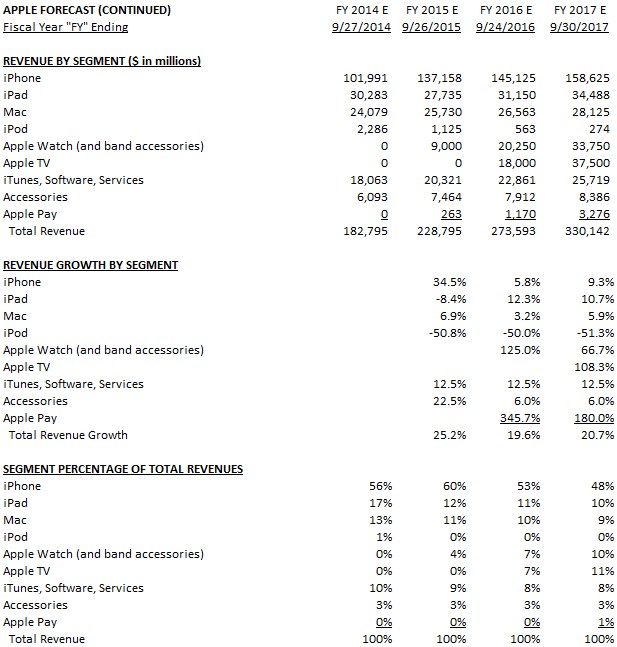

On August 13, 2013, when Apple was trading at just $66.77, we originally notified our twitter followers of our conversations with Tim Cook and of our request that Apple take advantage of its excess liquidity by repurchasing its dramatically undervalued shares. Despite significant share appreciation over a relatively short timeframe to $122 per share, we believe the same opportunity exists for Apple today. More recently, skeptics (including bullish Wall Street analysts) questioned our financial model’s forecast for robust growth, disclosed in a letter to Tim Cook on October 9, 2014 in which we again urged Apple to increase share repurchases. Since then, we have gained further confidence in our thesis, increasing the forecasted EPS for FY 2015 in our model from $9.60 to $9.70, and now believe the market should value Apple at $216 per share. This is why we continue to own approximately 53 million shares worth $6.5 billion, and why we have not sold a single share.

With respect to our increased EPS forecast of $9.70, we believe it’s important to note that we assume a 20% tax rate for the purpose of forecasting Apple’s real cash earnings, not the 26.2% “effective” tax rate used by Apple. We consider this an essential adjustment that many analysts and investors simply fail to understand. To further clarify, unlike many companies (including Google), Apple does not state that it plans to permanently reinvest international earnings. Because Apple does not state this, accounting rules require Apple on its income statement to accrue for an income tax on unremitted earnings, but it is a non-cash tax since Apple likely will not repatriate the international cash at today’s tax rate. Therefore, we believe the correct way to treat this non-cash tax for the purpose of valuation is to add it back to earnings, reflected in our EPS forecast. Since our previous letter, the consensus EPS (among the 31 analysts who have updated their EPS targets since January 28th) for FY2015 has dramatically increased to $8.59. Interestingly, if we make the same tax adjustment to this consensus EPS, the adjusted result is $9.31. So, while previously criticized by some of these analysts as being too aggressive, our updated EPS forecast of $9.70 is now only 39 cents above the tax adjusted consensus, and actually below several of the forecasts within that tax adjusted consensus.

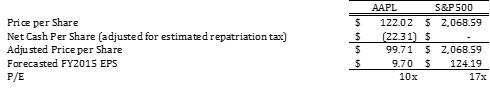

When we compare Apple’s P/E ratio to that of the S&P 500 index on the same basis (but without any tax adjustment to the S&P 500 forecasted FY2015 EPS or P/E), we find that the market continues to value Apple at a significantly discounted multiple of only 10x, compared to 17x for the S&P 500:

We believe this P/E multiple discrepancy between Apple and the broad market index is totally irrational. It seems to us the market is somehow missing a very basic principle of valuation: when a company’s future earnings are expected to grow at a much faster rate than that of the S&P 500, the market should value that company at a higher P/E multiple. In FY 2016 and FY 2017 we forecast in our model EPS growth of over 20% per year, and if Apple introduces a TV in FY 2016 as we expect, this EPS growth accelerates to over 31% per year in our model. Because of this, we believe the market should value Apple at a P/E of at least 20x, which together with net cash of $22 per share, would value Apple shares today at $216 per share. This is not a future price target. $216 is what we think Apple is worth TODAY. Also, to the extent Apple introduces a TV in FY 2016 or FY 2017, we believe this 20x multiple is conservative.

Given that our estimated value for Apple (excluding the introduction of a television) represents an 84% price appreciation from where the common shares trade today, we continue to hope that Tim Cook and Apple’s Board of Directors, on behalf of all shareholders, take advantage of this dramatic market value anomaly and increase the magnitude and rate of share repurchases while this remarkable opportunity still exists.

It is now plainly obvious to us that there will be no stopping Apple’s peerless innovation track record and best-in-class ecosystem of services, software, and hardware, and that Apple will continue dominating the premium smartphone market by continuing to take premium market share from Google’s Android operating system (and Android-device manufacturers) while at the same time maintaining or growing average selling prices and gross margins. We look forward to the introduction of the Apple Watch in April, as well as the launch of other new products in new categories.

The updated forecast from model is included on the following pages.

Additionally, on October 9, 2014 we wrote a long letter to Tim Cook that expressed our thoughts on Apple in greater detail.

You can find that letter here:

https://carlicahn.com/sale-apple-shares-at-half-price/.

Sincerely,

Carl C. Icahn

Brett Icahn

David Schechter

Important Disclosure Information

SPECIAL NOTE REGARDING THIS LETTER

THIS LETTER CONTAINS OUR CURRENT VIEWS ON THE VALUE OF APPLE SECURITIES AND ACTION THAT APPLE’S BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE (INCLUDING THE ASSUMPTIONS IDENTIFIED IN OUR OCTOBER 9, 2014 LETTER UNDER THE HEADING “REMAINING KEY ASSUMPTIONS”). THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED IS ACCURATE OR COMPLETE, NOR CAN THERE BE ANY ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. APPLE’S ACTUAL PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS. WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS LETTER. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN. WE DO NOT RECOMMEND OR ADVISE, NOR DO WE INTEND TO RECOMMEND OR ADVISE, ANY PERSON TO PURCHASE OR SELL SECURITIES AND NO ONE SHOULD RELY ON THIS LETTER OR ANY ASPECT OF THIS LETTER TO PURCHASE OR SELL SECURITIES OR CONSIDER PURCHASING OR SELLING SECURITIES. ALTHOUGH WE STATE IN THIS LETTER WHAT WE BELIEVE SHOULD BE THE VALUE OF APPLE’S SECURITIES, THIS LETTER DOES NOT PURPORT TO BE, NOR SHOULD IT BE READ, AS AN EXPRESSION OF ANY OPINION OR PREDICTION AS TO THE PRICE AT WHICH APPLE’S SECURITIES MAY TRADE AT ANY TIME. AS NOTED, THIS LETTER EXPRESSES OUR CURRENT VIEWS ON APPLE. IT ALSO DISCLOSES OUR CURRENT HOLDINGS OF APPLE SECURITIES. OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING APPLE WITHOUT UPDATING THIS LETTER OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES, EXEPT AS NOTED WITH RESPECT TO THE APPLE TENDER OFFER WE ARE ASKING THE APPLE BOARD TO AUTHORIZE. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING APPLE AND ITS PROSPECTS WITHOUT RELYING ON, OR EVEN CONSIDERING, ANY OF THE INFORMATION CONTAINED IN THIS LETTER.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this letter are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results to differ materially from the expectations set forth in this letter include, among other things, the factors identified under the section entitled “Risk Factors” in Apple’s Annual Report on Form 10-K for the year ended September 27, 2014. Such forward-looking statements should therefore be construed in light of such factors, and Icahn is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information on this and other topics, follow Carl Icahn on Twitter at:

@Carl_C_Icahn

https://twitter.com/Carl_C_Icahn

Contact:

Icahn Capital LP

Susan Gordon

(212) 702-4309